Last updated on April 25th, 2023 at 08:12 am

Donald Trump is an American politician, Media personality, and Businessman who served as the 45th President of the United States from 2017 to 2021. Although Trump’s life has been full of controversies, he has taken significant steps to improve America’s economic growth and trade policies. During his tenure, the American economy experienced a significant hike. President Trump’s economic policies have mixed results. While the corporate tax cut scheme likely stimulates the US economy to some extent, the long-term economic benefits are wearing off as business investment declines. By accumulating significant debt at a time of growth, Trump burdens future taxpayers for decades to come. Additionally, while the unemployment rate falls to a half-century record low of 3.5%, the pandemic causes a surge in unemployment, and monthly employment growth slows. While median American household incomes increase, some families struggle with lost income, unemployment, or underemployment.

Trump’s economic policies also face criticism for focusing on short-term stimulus rather than long-term growth. Instead of passing tax cuts, Trump could invest in programs that yield long-term growth, such as infrastructure investments or reducing the cost of higher education. The corporate tax cuts primarily benefit large corporations and the rich, rather than supporting households.

Tax Reform and Debt Management

The Tax Cuts and Jobs Act of 2017 is considered one bookend to Trump’s economic legacy, along with the Covid-19 pandemic. This sweeping tax code overhaul reduced the corporate tax rate from 35 percent to 21 percent, with proponents claiming that it would lead to higher wages for workers. However, executive compensation increased relative to average worker pay, and companies engaged in unprecedented stock buybacks instead of passing on the benefits to workers. Despite promises of 4 percent GDP growth, economic output only increased marginally during Trump’s term. The law’s tax breaks were designed to sunset after years, creating a future problem for Congress to address. Economists also warn that the TCJA has the potential to cause economic pain in the future, as the Treasury is projected to take in $1.8 trillion less revenue for a decade, which could lead to higher taxes and a higher cost of debt servicing.

President Trump’s policies have significantly increased the budget deficits and U.S. debt trajectory over the 2017-2027 time periods. The budget deficit rose from $666 billion in FY2017 to $779 billion in FY2018, an increase of $113 billion or 17.0%, and the FY2018 deficit was an estimated 3.9% of GDP, up from 3.5% of GDP in 2017. The debt additions projected by CBO for the 2017-2027 period have increased from the $10.0 trillion that Trump inherited from Obama (January 2017 CBO baseline) to $13.7 trillion (CBO January 2019 current policy baseline), a $3.7 trillion or 37% increase. Trump and his economic advisers initially pledged to radically decrease federal spending to reduce the country’s budget deficit, but the CBO forecast in the April 2018 baseline for the 2018-2027 period includes much larger annual deficits than the January 2017 baseline he inherited from President Obama, due to the Tax Cuts and Jobs Act and other spending bills.

Trade Policy: Tariffs, NAFTA, and China

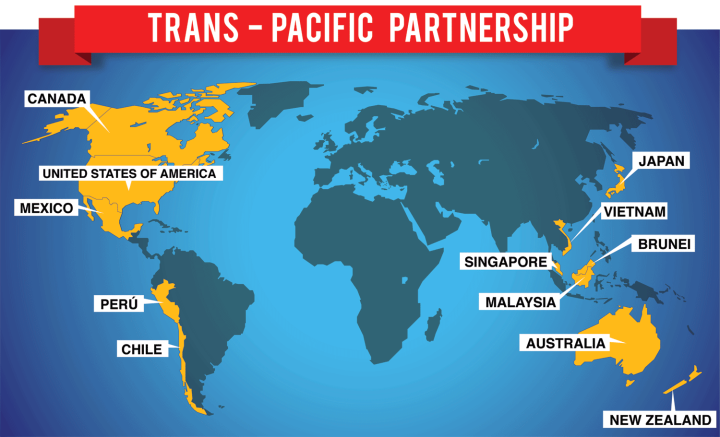

Trump’s trade policies sought to reduce the U.S. trade deficit. His first action was the U.S. withdrawal from further negotiations on the Trans-Pacific Partnership (TPP).

Trans-Pacific Partnership (TPP):

The Trans-Pacific Partnership (TPP) was a trade agreement between 12 countries, including the United States, Japan, and Canada. The goal of the TPP was to promote economic growth, increase employment, and reduce poverty by lowering tariffs, harmonizing regulations, and promoting investment between the participating countries. In 2017, President Trump withdrew the United States from the TPP negotiations, citing concerns that it would hurt U.S. workers and businesses.

North American Free Trade Agreement (NAFTA) and United States-Mexico-Canada Agreement (USMCA):

The North American Free Trade Agreement (NAFTA) was a trade agreement between the United States, Canada, and Mexico that came into effect in 1994. NAFTA eliminated tariffs on most goods traded between the three countries and promoted investment and economic growth. In 2018, the Trump Administration renegotiated NAFTA and created the United States-Mexico-Canada Agreement (USMCA). The USMCA made several changes to NAFTA, including new rules for auto manufacturing, increased access to Canadian dairy markets for U.S. farmers, and updated provisions on intellectual property, digital trade, and labor rights.

Iran:

The Iran nuclear deal, also known as the Joint Comprehensive Plan of Action (JCPOA), was an agreement between Iran and several world powers, including the United States, China, Russia, France, Germany, and the United Kingdom. The goal of the agreement was to limit Iran’s nuclear program in exchange for the lifting of economic sanctions. In 2018, President Trump withdrew the United States from the JCPOA, citing concerns that Iran was not complying with the terms of the agreement.

China:

The United States and China have engaged in a trade war since 2018, with both countries imposing tariffs on each other’s goods. In 2018, the Trump administration imposed tariffs on $250 billion worth of Chinese goods, and China retaliated with tariffs on $110 billion worth of U.S. products. In 2019, President Trump imposed a fourth round of tariffs, raising tariffs to 25% on $200 billion worth of Chinese goods. In December 2019, the two countries signed a Phase One trade deal, which included an agreement by China to increase imports of U.S. goods by $200 billion annually and a reduction in some U.S. tariffs on Chinese goods.

Deregulation: Reducing Government Regulations on Business

During his presidency trump has signed executive orders aimed at reducing the number and burden of federal regulations, and his administration has pursued several initiatives to roll back regulations across a range of policy areas, including environmental protection, labor, and finance. Some of these efforts have been successful, while others have faced legal challenges or have been delayed or reversed by subsequent administrations.

President Trump’s approach to deregulation was characterized by a few key elements:

Reduction in new regulations:

According to the Office of Information and Regulatory Affairs, the Trump Administration issued 3,982 new regulations during its first two years in office, compared to 5,968 in the first two years of the Obama administration.

Focus on major regulations:

The Trump administration issued just 76 new “major” regulations (defined as those with an annual economic impact of $100 million or more) during its first two years, compared to 129 during the first two years of the Obama administration.

Rollback of existing regulations:

The Trump administration has targeted numerous existing regulations for elimination or reduced stringency, particularly in areas such as environmental protection, labor and employment, and financial regulation. According to the White House Office of Management and Budget, the administration had taken significant deregulatory actions that saved an estimated $50 billion in regulatory costs as of September 2019.

Appointment of deregulatory-minded officials:

President Trump has appointed officials to key regulatory agencies who are generally skeptical of the need for government regulation, such as EPA Administrator Scott Pruitt (who resigned in 2018) and current EPA Administrator Andrew Wheeler, both of whom have ties to the fossil fuel industry.

Infrastructure: Proposed Infrastructure Plan and Impact

Donald Trump signed executive orders to revive the Keystone XL and Dakota Access oil pipelines, which were projected to have a minimal impact on the U.S. economy. He also pledged to invest $550 billion in infrastructure and create an infrastructure fund but failed to advance an infrastructure bill through Congress or create a U.S. infrastructure fund. Trump and congressional Republicans did not prioritize a major infrastructure bill, instead focusing on efforts to pass a tax-cut bill and repeal the Affordable Care Act. Later in his presidency, Trump tentatively agreed with Democratic congressional leadership for a $2 trillion infrastructure package, but the agreement collapsed after Trump accused Democrats of launching “phony investigations” against him. Federal investments in water infrastructure declined to a 30-year low during Trump’s tenure, while federal investments in road and bridge transportation stagnated.

Inflation:

Inflation during the Donald Trump period was generally low and remained within the range of 1-2.5%. The consumer price index for all items rose from 1.3% in 2016 to 2.1% in 2017 and 2.5% year-to-date (YTD) in June 2018, mainly due to higher energy prices. However, core inflation, which excludes volatile food and energy prices, remained relatively flat, at 2.2% in 2016, 1.8% in 2017, and 2.1% YTD in June 2018. Overall, inflation during the Trump period was generally consistent with the trend of low inflation observed in the US economy since the Great Recession.

Energy:

During Trump’s presidency, there were efforts to intervene in energy markets to protect the coal and nuclear industries, as well as regulatory relief for the coal mining industry. In May 2018, Trump ordered the Department of Energy to conduct an unprecedented intervention to subsidize certain resources in the energy markets. This move was criticized for potentially causing significant rate increases without any corresponding benefits. The administration also moved to repeal the Clean Power Plan, which was designed to reduce carbon emissions from power plants. The Energy Information Administration projected that coal production would decline faster without the CPP in effect. Despite these efforts, coal-fueled electricity generating capacity declined faster during Trump’s presidency than during any previous presidential term, with a 15% decrease in capacity due to the idling of 145 coal-burning units at 75 power plants. The percentage of electricity generated by coal was expected to drop from 31% in 2017 to 20% in 2020.

Federal Reserve: Trump’s Views and Actions on Monetary Policy

Former U.S. President Donald Trump had been a vocal critic of the Federal Reserve’s monetary policy during his presidency, often accusing the central bank of hindering economic growth by raising interest rates too quickly and too often. He argued that the Fed’s tight monetary policies were based on an irrational fear of inflation and were unnecessary.

During Trump’s first two years in office, the Fed raised its federal fund rate eight times from a range of 0.5-0.75 percent to a range of 2.25-2.5 percent. Meanwhile, it raised its discount rate from 1.25 percent to three percent. Trump accused the central bank of playing politics with the economy and criticized its monetary policies.

In response to the COVID-19 pandemic, the Fed cut rates to near zero in March 2020 and implemented several other emergency measures to support the economy, including massive asset purchases. Trump had initially supported the Fed’s actions in response to the pandemic but later criticized the central bank for not doing enough to support the economy.

The Fed’s current chairman, Jerome Powell, has acknowledged that the central bank’s deflationary policies had unnecessarily held back economic activity and income growth and that persistently low inflation can pose serious risks to the economy. The Fed has now revised its policy and seeks to achieve inflation that averages two percent over time. It will likely aim to achieve inflation moderately above two percent for some time following periods when inflation has been running persistently below two percent.

Budget: Impact of Trump’s Policies on the Federal Budget

During his presidency the federal budget deficit increased significantly, reaching a peak of $3.1 trillion in the fiscal year 2020 due to the economic impact of the COVID-19 pandemic and the CARES Act. However, even before the pandemic, the deficit had been on an upward trend, increasing from $585 billion in the fiscal year 2016 (the last year of Obama’s presidency) to $984 billion in the fiscal year 2019.

The tax cuts that Trump signed into law in December 2017 were expected to boost economic growth and increase tax revenues. However, the effects of the tax cuts on economic growth and revenue were less than expected, and the Joint Committee on Taxation estimated that they would add $1.9 trillion to the deficit over 10 years.

Trump’s deregulatory policies were aimed at reducing the cost of compliance for businesses, which could lead to increased investment and job creation. However, the impact of these policies on the federal budget is difficult to quantify.

Trump’s increased military spending was aimed at strengthening the nation’s defense, but it also contributed to the growing budget deficit. In the fiscal year 2019, military spending was $686 billion, a 4.9% increase from the previous year. Trump’s border wall construction also contributed to the growing deficit, with the estimated cost of the project reaching $15 billion in 2020.

Healthcare

Trump signed an executive order in October 2017 that directed federal agencies to expand access to short-term, limited-duration health insurance plans, which can offer cheaper premiums but may not cover all essential health benefits required under the ACA. Critics argued that this could undermine the ACA’s marketplaces by drawing healthier customers away from the plans, leaving sicker customers in the exchanges, and driving up premiums. In June 2018, the Trump administration finalized a rule to extend the duration of these plans to up to 12 months, with the option to renew for up to three years.

In October 2018, Trump signed a bipartisan bill called the Support for Patients and Communities Act, which aimed to address the opioid crisis by expanding access to treatment and recovery services, improving data collection and sharing among state prescription drug monitoring programs, and cracking down on illicit opioid imports.

Trump’s proposed budgets for fiscal years 2018, 2019, and 2020 included deep cuts to Medicaid and the Children’s Health Insurance Program (CHIP), which provide health coverage to low-income Americans. These cuts were not enacted by Congress, but experts warned that they could have resulted in millions of people losing their insurance or experiencing reduced benefits.

In 2019, the Trump administration issued a proposed rule that would require hospitals to disclose the prices they negotiate with insurers for common services, as well as the prices they charge cash-paying customers. The rule was challenged in court by hospital groups, and a federal judge struck it down in 2021.

Trump’s efforts to repeal and replace the ACA were unsuccessful, despite a Republican-controlled Congress in 2017 and 2018. In 2019, however, the Trump administration backed a lawsuit filed by a group of Republican state attorneys general that sought to declare the entire ACA unconstitutional. The Supreme Court ultimately upheld the law in a 7-2 decision in June 2021, with conservative justices Amy Coney Barrett and Brett Kavanaugh siding with the majority.

The Covid-19 Pandemic

In March 2020, President Trump signed the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which provided $2.2 trillion in relief to individuals, businesses, and governments affected by the pandemic. This included direct payments to individuals, expanded unemployment benefits, and funding for small businesses and hospitals.

In August 2020, President Trump signed four executive orders aimed at providing additional relief to Americans during the pandemic. These orders addressed unemployment benefits, student loan relief, eviction protections, and payroll tax deferral.

In December 2020, President Trump signed the COVID-19 Economic Relief Act, which provided $900 billion in relief to individuals, businesses, and governments affected by the pandemic. This included direct payments to individuals, expanded unemployment benefits, and funding for small businesses, schools, and vaccine distribution.

In March 2021, President Biden signed the American Rescue Plan, which provided $1.9 trillion in additional relief to individuals, businesses, and governments affected by the pandemic. This included direct payments to individuals, expanded unemployment benefits, funding for small businesses, schools, and vaccine distribution, and aid to state and local governments.

Employment and Wages: Trump’s Record on Job Creation and Minimum Wage

In 2016, while campaigning for president, Trump promised to create 25 million jobs. However, his efforts to create jobs faced a setback when the Rebuild America plan, which was aimed at creating jobs, was stalled by legislators. The plan was meant to provide $200 billion in spending over 10 years, which was expected to attract billions in business spending and reduce the permit process time by eight years.

Between 2017 and 2019, Trump managed to create 6.6 million jobs. However, the COVID-19 pandemic, which hit the US in early 2020, caused a sharp decline in job growth, with the economy losing 20.5 million jobs in April 2020 alone. By the end of 2020, the unemployment rate had declined to 6.7%, which was significantly less than the high of 14.8% during the pandemic but was still more than double the pre-pandemic unemployment rate.

So, to summarize, Trump promised to create 25 million jobs while campaigning in 2016. Between 2017 and 2019, he created 6.6 million jobs. However, the pandemic-induced recession caused a sharp decline in job growth, with the economy losing 20.5 million jobs in April 2020 alone. By the end of 2020, the unemployment rate had declined to 6.7%, which was still more than double the pre-pandemic unemployment rate.

Income Inequality: The Impact of Trump’s Policies on Income Distribution

The issue of growing income inequality during the Trump administration is indeed an important part of his legacy. While income inequality has been a longstanding problem in the United States, it is clear that under Trump’s leadership, it continued to worsen. This has resulted in a wide range of negative consequences for millions of Americans, including unaffordable housing, lack of access to healthcare, and growing poverty rates among children.

Trump’s policies, including his deregulation efforts and tax cuts that favored the wealthy, likely contributed to this trend. Additionally, his mishandling of the COVID-19 pandemic further exacerbated these inequalities, as many vulnerable segments of society lost their livelihoods due to the economic fallout of the pandemic.

While it is true that income inequality has deep roots and is a complex problem to solve, it is also clear that Trump’s policies did not help to address this issue. As such, policymakers must continue to prioritize efforts to reduce income inequality and create a more equitable society for all Americans.

Global Economic Impact: The Effects of Trump’s Policies on the Global Economy

President Trump’s policies had a significant impact on the global economy during his time in office. Here are some of the key effects:

Trade War with China:

One of Trump’s most significant economic policies was his trade war with China, which involved the implementation of tariffs on billions of dollars worth of goods. This led to retaliatory tariffs from China, resulting in a slowdown of global trade and negatively impacting the global economy.

Withdrawal from the Trans-Pacific Partnership:

Trump also withdrew from the Trans-Pacific Partnership, a trade deal that involved 12 Pacific Rim countries, including the United States. This decision weakened America’s economic influence in the region and gave China more leverage in the global economy.

NAFTA Renegotiation:

Trump also renegotiated the North American Free Trade Agreement (NAFTA) with Canada and Mexico. The new agreement, known as the United States-Mexico-Canada Agreement (USMCA), included updated provisions on labor and environmental standards but also increased barriers to trade in certain sectors.

Tax Cuts and Jobs Act:

Trump’s Tax Cuts and Jobs Act lowered corporate tax rates and provided tax relief for individuals, which led to increased business investment and economic growth in the short term. However, the long-term effects of this policy are still uncertain and may contribute to increasing levels of debt.

Immigration Policies:

Trump’s strict immigration policies, including the travel ban and efforts to limit legal immigration, could also have negative effects on the global economy by limiting the flow of skilled workers and reducing economic growth.

Key Achievements of Donald Trump

Here are some notable actions and policies that the former 45th President of the United States pursued during his presidency:

- Passed the Tax Cuts and Jobs Act of 2017, which reduced corporate and individual tax rates, increased the standard deduction, and eliminated some deductions and exemptions.

- Signed several executive orders aimed at reducing federal regulations and bureaucracy, including a “two-for-one” rule requiring agencies to eliminate two existing regulations for every new one proposed.

- Appointed three Supreme Court Justices and numerous federal judges, including many who are considered conservative.

- Successfully negotiated the United States-Mexico-Canada Agreement (USMCA), which replaced the North American Free Trade Agreement (NAFTA), and made changes to rules regarding auto manufacturing, dairy trade, and intellectual property protections.

- Signed the First Step Act, which aimed to reform the federal criminal justice system by reducing mandatory minimum sentences for nonviolent drug offenses and providing more opportunities for early release and rehabilitation.

- Announced the creation of the Space Force as a new branch of the U.S. military.

Reversed several Obama-era policies and regulations, including withdrawing from the Paris climate agreement, repealing the Clean Power Plan, and loosening environmental protections on federal lands and waters. - Implemented a “zero-tolerance” immigration policy that resulted in the separation of thousands of migrant families at the U.S.-Mexico border. Later reversed this policy through an executive order.

- Negotiated with North Korea’s leader Kim Jong-un, holding summits and exchanging letters to denuclearize the Korean peninsula. However, no significant progress was made in this regard.

- Imposed tariffs on various goods imported from China, Canada, Mexico, and other countries, to reduce trade deficits and protect American industries. This policy was controversial and drew criticism from many economists and businesses.

Conclusion: Evaluating the Overall Impact of Trump’s Economic Policy

Donald Trump’s presidency is a controversial and divisive period in American politics, marked by numerous controversies, scandals, and policy changes.

Some of the notable accomplishments during his presidency include tax cuts, criminal justice reform, renegotiating trade deals, and the creation of the Space Force. However, his presidency is also marked by controversies such as the Mueller investigation, impeachment proceedings, criticism for his handling of the COVID-19 pandemic, and the storming of the US Capitol by his supporters.

Ultimately, Donald Trump’s presidency is a turbulent period in American politics that continues to be analyzed and debated. Despite the end of his presidency on January 20, 2021, with the inauguration of Joe Biden as the 46th President of the United States, he is expected to run for the 2024 presidential election and challenge the incumbent Joe Biden.